What is Bharat Credit Builder – BCB?

“Bharat Credit Builder” or “BCB” is a suite of services offered by Rupymart Tech Private Limited, referring to Credit advisory services provided by professionals with decades of experience. BCB aims to provide guidance to customers for improving their Credit Profile and inculcate financial discipline.

What is BCB Credit Report Analysis (CRA)?

We analyze Credit Information Report (CIR) provided by Credit Bureaus (Transunion CIBIL, Equifax, Experian and/or CRIF Highmark).

Credit Report Analysis helps:

- To understand/highlight area of improvement in CIR.

- To improve & increase Credit Score.

- To improve Credit Score after default.

Our Credit experts will make you understand how to improve your Credit Profile and how to improve Credit Score after default.

What is BCB Bank Statement Analysis (BSA)?

Banks calculate your loan eligibility based on the transactions recorded in your bank statement. It provides a complete picture of the financial transactions entered into over a period of time. An in-depth analysis of your Bank statements helps you in managing your finances better.

Bank Statement Analysis leads:

- To identify sources of income and expenditure.

- To understand loan eligibility.

- To identify areas of improvement in future transactions.

What is Error(s) Correction?

At times there are erroneous entries in your Credit Information Report (CIR), such as closed loan status yet to be updated, wrong Days Past Due (DPD) data, incorrect address or contact details, etc. We will help you in identifying and correcting these errors with Credit bureaus.

What is BCB Credit Improvement Program (CIP)?

BCB CIP is a comprehensive mechanism individually tailored to the requirements of each individual. The goal of the program is to improve the Credit Score by targeting the areas of improvement in financial history and future transactions. Our program is built on the following principles:

- Transparent and genuine advice: We understand that each individual has different needs and financial constraints/resources. We believe in guiding you but will never make false or misleading promises. Our role is limited to providing you with impactful advice, but the implementation of the same remains your sole responsibility.

- Personalized service: We assign each individual to a specific Credit Expert on our team. The Credit Expert’s role is to understand your Credit history and provide you with the best possible solutions/support.

- Data based scientific approach: Our unique data driven approach helps us in understanding your specific requirements and suggest optimum solutions.

How long does it take to improve Credit Score after I subscribe to BCB CIP?

You are unique, and so is your Credit Score composition. Each individual has a different Credit situation, and a lot depends on where you are in the journey. On an average, our members are expected to see results in six months.

Why should I pay BCB for Credit Score Improvement Services?

We are professionals who charge for a specialized set of services. We request you to consider service-related payments to us as an investment for a better financial future. A relatively small amount today may save you lakhs on future loans and save you from loan rejections.

Can BCB guarantee Credit Score Improvement?

Sadly, no! Credit Score Improvement depends on your individual profile and cannot be universally guaranteed. However, we do confirm that our team will leverage all the expertise at our disposal to help you reach the credit score you deserve.

What is Dispute Resolution?

The BCB Dispute Resolution service refers to situations where instances of “Settled”, “Write Off”, “Post Written Off Settled” or similar issues are present in your Credit Information Report. We help you by following the under mentioned steps:

- BCB will arrange for the Payable amount from the lender.

- Exclusive repayment options which may include discount/EMI.

- Once paid in full, Credit Bureaus will be updated for clean closure.

How does BCB provide Legal assistance for Disputes/Settlements?

BCB’s will refer your issue(s) to experienced lawyer(s) empaneled with us for a speedy, fair and effective resolution.

What is BCB Credit Builder Loans?

Credit Builder Loans are designed to promote good financial behaviour and help you establish and/or rebuild a positive payment history. As long as you make payments on time, your loan payments are reported to the national credit bureaus, helping you establish a positive credit history. (If you miss payments, that will reflect negatively on your credit.)

In case you subscribe to the service, BCB will refer your proposal/profile to appropriate Banks/NBFCs for their consideration/approval.

General FAQs

What is a Credit Score?

A Credit Score is a number computed by an approved credit rating agency and it provides a hint of the credit worthiness of an individual. The three-digit credit score plays an important role in getting you the credit you want at better rates. Credit score in India is provided four credit bureaus namely, Equifax, Experian™, CIBIL™ and CRIF Highmark™ which ranges between 300 to 900.

An individual’s Credit Score provides a credit institution with an indication of the “probability of default” of the individual, based on their credit history. A Credit Score tells a lender / credit institution (typically banks or NBFCs) how likely you are to pay back a loan based on your past pattern of credit usage and loan repayment behaviour.

What is a CIBIL™ score?

CIBIL™ is one of the four authorized credit bureaus or Credit Information Companies (CICs) in India, the others being Equifax, CRIF High Mark and Experian which provide a credit score through their Credit Information Report (CIR).

Credit score is a tool for lenders to check the borrower’s credit worthiness and capacity to repay loans. If you have a good credit score and history lenders will typically approve your loan and credit card applications. The credit score is calculated by each bureau based on the information provided to them by lenders.

Your credit score is a 3-digit number and ranges between 300 and 900. If you have a credit score more than 750, it means that you have a good credit score. In this case, there will be many lenders who will be willing to lend to you.

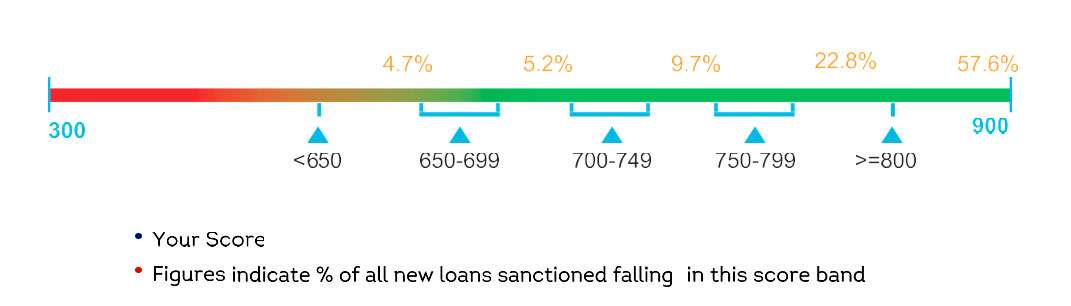

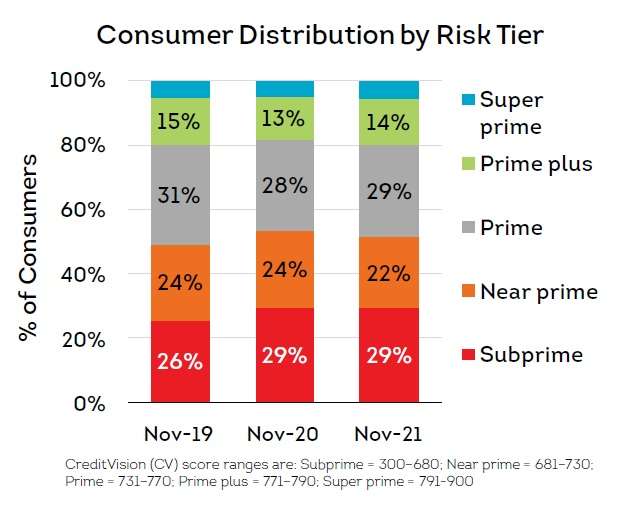

As per TransUnion CIBIL, the Indian CreditVision® Risk Score has been categorized as under:

| Subprime | 300-680 |

| Near prime | 681-730 |

| Prime | 731-770 |

| Prime Plus | 771-790 |

| Super Prime | 791-900 |

The percentage wise Credit Score distribution in India, as provided in TransUnion CIBIL CMI Report (Second Edition, March 2022) is provided here under. We can see from the data here under that more than half (>50%) of consumers have a CIBIL score of less than 750.

Why Credit Score is important?

Your credit score is basically your reputation around how you handle money. If you have a good reputation, it can be a powerful tool to help you improve your lifestyle by allowing you to buy things you might otherwise have to save for years to buy or pay for say a bike, car, home, vacation, etc. Now a days, credit score is also required in connection with Employment Screenings, Home or apartment rentals, Mobile Postpaid limits, etc.

Who provides/calculates Credit Scores in India?

In India, the credit score of individuals is the provided by four Credit Information Companies (CICs) – Equifax™, CIBIL™, Experian™ and CRIF High Mark™. From lenders they collect the data of individuals who have taken any of credit compiling them in the form of a credit report based on which they calculate the credit score using their own proprietary algorithm.

Why each Credit Information Company provides different Credit Scores for the same individual in India?

If you obtain credit score from different bureaus, you will notice that your score varies from bureau to bureau.

This is primarily because:

- Each bureau has its own method/algorithm to calculate credit score.

- Your lender might not have reported your recent data to a credit bureau or might not be reporting to a particular bureau at all.

Though your score may vary the lender knows the different parameters used by various bureaus and weigh the scores equally.

Importance/Benefits of Good Vs Bad Vs No Credit Score

All of us fall into one of three categories when it comes to Credit Score – Good, Bad or No Score. The table mentioned here under will provide you an idea with regard to the importance of Credit Score and its benefits.

| Good Score | Bad Score | No Score | |

| Range | 750 and above | Below 750 | No credit activities reported |

| Interest rate on loans | Low | High | Average, fixed based on income and employer |

| Loan approval rate | High | Low | Depends on the policies of the lender |

| Payment history | Good | Poor (Late payments and defaults) | No history |

| Credit utilization ratio | Excellent | Poor | No records found |

How to check Credit Score for free?

Checking your credit score frequently helps you make smart financial decisions. Based on the score and your other financial information, you may approach a bank to apply for a loan or credit card and bargain for better terms. Even a small reduction in the interest rate of big-ticket loans can save you a lot of money in the long run.

One may check his/her own credit score for free through one of the following:

- Credit Bureaus: As per RBI mandate, each credit bureau should give your credit report and score for free once a year. You can check it online at their official website or by mailing them.

- Third-Party Financial Portals: Third party financial sites provide credit score for free round the year. You can check it anytime from anywhere and it’s completely free. Checking your credit score does not hurt it, and you can check it for any number of times.

- Banks: These days some of the banks also provide credit score. Some lenders charge a fee while some provide it for free.

What information is required for checking Credit Score?

One is required to generally provide the following information for checking Credit Score:

- Name: The name should be your original name which is recorded in your PAN and other official copies such as Voter ID, Passport, Birth Certificate, etc.

- Date of Birth: The date of birth is mandatory to check your free credit score. This should match with the birth detail on your PAN and other official records.

- PAN: This is the most important proof that is required to fetch your credit score from the bureau.

- Gender: You may have to mention which gender you belong.

- Mobile Number: You need to mention your mobile in order to verify your profile. An OTP will be sent to your mobile for verification.

- Employment Details: Information such as your employer, monthly salary and type of employment may be required to get your credit score.

- PIN Code: You need to enter the PIN code of the locality where you stay permanently.

What is Soft Enquiry and Hard Enquiry of Credit Score?

Soft Enquiry: When you check your own Credit Score through Credit Bureaus, Banks or Third-Party websites, it is referred to as a “Soft Enquiry”, and it does not affect your credit score.

Hard Enquiry: When a lender, such as a Bank or NBFC, checks your credit score at the time of your loan application, it is referred to as a “Hard Enquiry”. In case of multiple applications to Banks/NBFCs, multiple hard enquiries are made, which may have a negative impact on your credit score.

How to maintain a Good Credit Score in India?

- Borrow only what you need when you need it.

- Pay your EMIs on time every month.

- Regular and on time bill payment has the highest weightage when calculating your credit score. So always pay your credit card bill or loan EMI on time. Make sure you have set up an alert to remind you about payments or opt for automatic payment where the lender withdraws the money owed on the day already decided by you.

- Keep your credit utilization low

- Keep your credit card balances below 30% of your borrowing limit—and try to stay below 10% or pay off your balances in full each month.

- Don’t close old credit cards.

- When you close old credit cards the card issuer stops sending updates to the credit bureaus. The credit bureaus also give less weightage to closed accounts. This could bring about reduction in your credit score. Also, your overall credit limit reduces which means your spending capacity and staying below the ideal credit utilization ratio is difficult. You must remember that after 10 years the closed credit card account will be removed from your credit report which could bring down your score when your really don’t want it to happen.

- Limit new credit applications.

- It is best to limit new credit application within a short time period as each hard enquiry will be listed on your credit report, which brings down your credit score. Also, if lenders see a lot of enquiries listed on your credit report, they will get the impression that you are desperate for credit and don’t know how to manage your finances.

- Monitor your credit report regularly.

The key to a Good Credit Score is to stay consistent over the long haul. Your score will tend to increase over time, as you demonstrate long-term financial discipline.

What are the benefits of a Good Credit Score?

A Credit Score is normally the first thing that a Lender checks when you apply for a loan. In case the Credit Score is low, the application may be rejected at initial level only. A Good Credit Score leads to Eligibility check basis financial and other document/details submitted by you. Lenders prefer applicants with good credit score as they show positive track record of repayments and financial discipline.

The benefits of a Good Credit Score are:

- Low interest rates: Individuals with a good credit score can secure loans with a good rate of interest. A high interest rate loan can pinch your pocket and become a burdensome in the long run.

- High chances of loans/credit card approval: A good credit score adds to the Credit Evaluation process followed by Banks.

- Higher limits on credit cards: The good credit score can make you eligible for higher credit card limits. Higher limits can help keep your credit utilization ratio low and thus improve your score further.

- Better Deals: With a good credit score, you may negotiate with Lenders and get the best deal possible.

What a good credit score won’t do for you?

Even a “perfect” Credit Score of 900 won’t qualify you for a loan you can’t possibly afford. Before you can finance a personal jet, for instance, your lender will want to see evidence of income, savings, or other assets you can tap to make the monthly payments. While that cost might exceed the grasp of middle-class households, an exceptional credit score does not.

A great credit score is possible for anyone, and having one makes it easier and more affordable to finance purchases within your means, no matter what income bracket you fall into.

How are credit scores calculated?

Computer algorithms called credit scoring models assign credit scores using complex

statistical analyses that predict your likelihood of defaulting on your loans (i.e., being 90 days or more overdue on a payment). These models look for combinations of data in your credit report that historically have been associated with payment defaults across large consumer populations—and assign scores based on their prevalence (or absence) in your credit history.

There are hundreds of different credit scoring models available to lenders. Each differs

somewhat in the way it calculates your score, and the specific math each one uses is kept secret for competitive purposes—and to prevent tampering or gaming the system.

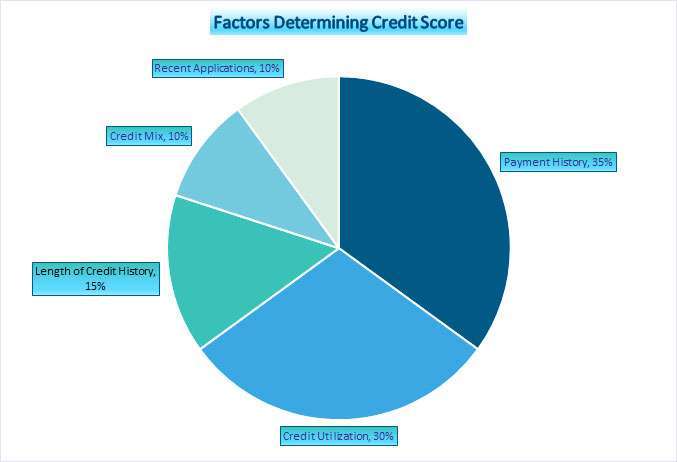

What are the factors determining my Credit Score?

- Payment history: A history of paying bills on time helps your credit score, while late or missed payments tend to lower it. Payment history is the single biggest scoring factor, accounting for as much as 35% of your Credit Score.

- Credit utilization: Credit utilization is the amount of available credit you’re using. To determine your credit utilization ratio, add up your outstanding balances on revolving credit accounts (such as credit cards) and divide that by the sum of the credit limits on those accounts. Then multiply by 100 to get your utilization percentage. If you owe Rs. 2,500 on your credit cards with a total credit limit of Rs. 10,000 your credit utilization rate is 25%. Your credit score will suffer as you “max out” your credit limit by pushing utilization on any one card, or in total, toward 100%. Experts recommend keeping your utilization ratio below 30% to avoid a substantial and rapid decrease in your credit scores. For the highest credit scores, you should aim to keep your utilization below 10%. Amounts owed on your accounts is responsible for about 30% of your Credit Score.

- Length of credit history: Your credit scores will tend to rise over time as you gain experience handling debt. If you’ve only been using credit for a few months or years, you can’t do anything to accelerate that, but establishing a record of timely payments early on in life will help you benefit as much as possible as your history stretches on. Length of credit history can constitute up to 15% of your Credit Score.

- Credit mix: Credit scores reflect the total amount of outstanding debt you have and the types of credit you use. A variety of loans, including both installment loans and revolving credit, can lead to higher Scores. Credit mix can influence up to 10% of your Credit Score.

- Recent applications: When you apply for a loan or credit card, you trigger a process known as a hard inquiry, in which the lender requests your credit history (and often your credit report as well). Hard inquiries typically can have a small, short-term negative effect on your credit score. As long as you continue to pay your bills on time, your credit score typically will rebound quickly from the effects of hard inquiries. (Checking your own credit is a soft inquiry and does not impact your credit score.) Recent credit applications can account for up to 10% of your Credit Score, but they are normally never the sole reason an application is declined.

What factors impact credit score negatively?

Poor credit score is a direct result of poor credit behaviour and financial indiscipline. It’s important to identify poor financial behaviour to make things right.

The most common factors which impact Credit Score negatively are:

- Late Repayments: Even one or two delayed credit card bill or loan repayments can affect credit score negatively. The more the number of delayed payments, the greater is the negative impact on your credit history and credit score. Though you may repay the amount later with a penalty to the lender, it gets reported by the lender as delayed payment to the credit bureaus.

- Missed payments: Repayment history is the most important factor contributing to Credit Score. Even a single default can hurt your credit score, making it difficult to avail credit in the future.

- Poor Credit Card Utilization: Maxing out credit card limit implies you are credit hungry which could impact your credit score negatively. Experts recommend that having a credit utilization ratio of 30% and below is good for your credit score. In case you use your credit card often, you can request for a higher credit limit on your credit card or get another card to balance the credit utilization ratio.

- Multiple Loan Applications: A hard enquiry can negatively impact your credit score; so one must keep tabs on loan applications. Applying for the same loan with multiple lenders can work against you as multiple enquiries are made. Hence, apply with the lender only where the approval chances are higher.

- Administrative Error: Occasionally, there may be an administrative error that results in wrong information being recorded on your credit report. Sometimes, this might be the result of fraudulent activity as well. For no fault of yours, these errors could lead to a lower credit score, signaling to future lenders that you have bad credit.

- Foreclosure: It happens in secured loans, wherein the lender sells the property through auctions to retrieve the outstanding loan amount. It can significantly reduce your credit score.

- Written-off: The lender may write off your loan or credit card account if you have continuously defaulted on repayments for more than 180 days. This gets reported to the credit bureaus by the lender, and your credit report shows written-off status. This can affect your credit score negatively and make you ineligible to avail loans.

- Settled: When you are unable to repay the loan, the lender allows you to settle the loan account for a mutually agreed amount which would be lower than the outstanding loan amount. This is a negative issue which will impact your credit score negatively.

How to get a Credit Score if I have zero or nil Credit Score?

There are people who have never taken loans or credit cards due to which they will not have a credit history and hence no credit score. As long as you maintain good credit habits—paying your bills on time and avoiding excessive use of credit cards and other revolving credit—your credit is likely to improve over the course of your life. But everyone has to start somewhere and, unfortunately, that creates a problem. If you don’t have a credit history or any data to draw from, lenders might be hesitant to lend you the money. But you’ll never establish your credit if they won’t give you a chance to prove your creditworthiness. Here’s what you can do:

- Become an authorized user on an established credit user’s account.

A parent requesting a card for use by their child can help the youngster establish a

credit history. The primary cardholder will be ultimately responsible for payments, so be sure they have a positive payment history—and discuss whether you can use the card and how your payments will be handled.

- Open a new credit account jointly with an established credit user.

If you’re over 18, a parent, spouse or friend can apply for credit jointly with you. The loan or credit card account will be listed in both of your names, and usage and payment activity will appear on both cosigners’ credit reports. A word of warning, however: Both parties’ credit will suffer if the card is misused. Also, some card issuers don’t offer this option.

- Obtain a secured loan such as Credit Card against Fixed Deposit, Loan against Fixed Deposit or Gold Loan, etc.

With a secured loan, the borrower puts down a cash deposit equal to the spending

limit on the card/loan. Purchases and payments will be reported to the credit bureaus and can help establish a credit history. If payments are made on time and balances stay low, secured cards/loans can be an excellent way to build credit.

- Get a Credit-Builder loan.

This type of loan is designed to promote good financial behaviour and help you establish or rebuild a positive payment history. As long as you make payments on time, your loan payments are reported to the national credit bureaus, helping you establish a positive credit history. (If you miss payments, that will reflect negatively on your credit.) When researching Credit Builder loans, make sure the provider reports payments to the credit bureaus.

How to improve credit score?

A good Credit Score means that you are a financially disciplined person who can be trusted to respect financial commitments. The journey to a good credit score comprises of the following steps:

- Step 1: Understand your earnings and spending

Know how much you make, understand all the deductions, the reasons behind it, and track where you spend your money. This will give you knowledge of your income and expenditure. You should regularly analyze your Bank statements to track your spending, inflows, and outflows.

- Step 2: Plan your finances

Write down your financial problems and goals. Writing them down gives you clarity and finality, rather than constantly thinking and worrying about your finances without having a clear idea of what the issues are. After which you need to plan what you want to do for example, do you want to pay of your credit card debt in 3 months (or) save a certain amount of money before a certain time (or) pay the down payment for a new house. Decide on what you want to achieve.

- Step 3: Implement your plan

This is the most difficult part – doing. Implementation of your plan should include

- Watch Your Spends

Do not spend more than what you have. Even better decide a cut-off point and save the rest. Try to keep your spending below your cut-off point. Credit card holders need to pay off their debts on time and keep their credit limited to 30% below credit utilization ratio.

- Find ways to increase your income

Find alternate sources of earning income like freelance article writing, part time jobs in retail shops or any other means which you are comfortable with. Use this fund wisely or save it for emergency purposes.

- Pay off your debt:

Pay off your existing credit card, education loan, car loan etc. This needs to be your priority. This is eating away at your salary every month and needs to be closed as soon as possible. Aggressive payment of debts is what is required here.

- Step 4: Review, Monitor and Adjust

After implementation review your actuals with plan. If there is deviation, adjust it accordingly. Continuously review your results on a weekly basis. This way you will know what you are earning and how much you are spending and if you are on track with your goal.

How long does it take to improve your credit score?

Since the credit score is based on consistent performance, one can assume you need to give yourself minimum six months for your score to show significant improvement, and sometimes the entire process can even take up to a year.

After you have identified you have a low credit score, you may subscribe for credit improvement services offered by various financial services companies or approach the lender to pay off your past dues. The first thing you need to do is to get your outstanding dues from the lender and pay them back in full. After having made the repayment, get a ‘No Due Certificate’ which confirms that you have cleared all the dues.

After making the payment, the lender will report your payment details to the credit bureaus who keep a record of your credit activities. Upon receiving the information from the lender, the bureaus will remove the negative issues from your account and update the latest payment details on your record. You have now successfully moved away from having bad credit. However, this is just the beginning.

For example, if you have a credit score of 480 at the time of removing your negative account, your credit score will remain the same in the future unless you have an active loan or credit card. On repaying the current loan and credit card bill consistently, you can improve your credit score considerably. A steady increase can be witnessed on being regular with repayment.

Points to Keep in Mind While Closing Your Negative issues

- No Due Certificate: After paying your outstanding dues in full, obtain a ‘No Due Certificate’ from the lender. This is the proof and indication that you have closed the loan completely.

- Incorrect Closure of Credit Card: Sometimes, the credit card issuer might offer you discount on closing the outstanding dues on your credit card. Lured by the offer, you might tend to settle for 80% or 90% of the amount to be paid. However, this is not a complete closure. The discount will not be taken into consideration by the bureaus and eventually you remain with bad credit.

- Removing negative issues off your credit report does not mean it will improve your credit score, it can only prevent a further drop. You should have a loan or credit card account active to get an improved credit score over a period.

Becoming credit healthy does not happen in a day. You will have to be patient as there is a certain procedure followed across all banks and credit bureaus. Get your credit report and check for any errors on it. By raising a dispute resolution with the lender and credit bureau, you can get the errors removed. Your credit score is the reflection of your credit health. Just like taking care of your physical well-being, it’s vital you take care of your credit health to get attractive terms and quick approval on your loans.

What is a Credit Information Report (CIR)?

Credit Information report (CIR) summarizes your history of managing debt and certain other financial obligations. Credit reports are maintained by four Credit Information Companies (CICs) in India, namely TransUnion®, CRIF HIGHMARK®, Experian®, and Equifax®, which compile debt and payment data reported voluntarily by lenders. They’re comprised of among other things:

- Total debt you have today

- Credit accounts you opened in the past

- Your history of repaying debts (on time, late or missed)

Sometimes credit reports may also include your history of rent or utility payments, but the number of landlords and utilities that report payment information to the credit bureaus

is very small.

Your credit report might report issues such as:

- Loan defaults

- Settled/Write off Loans

- Disputes

The things not available in a Credit report are:

- Race

- Ethnicity

- Marital status

- Income

- Medical history

- Purchase history

- Bank balances

- Criminal records

- Level of education